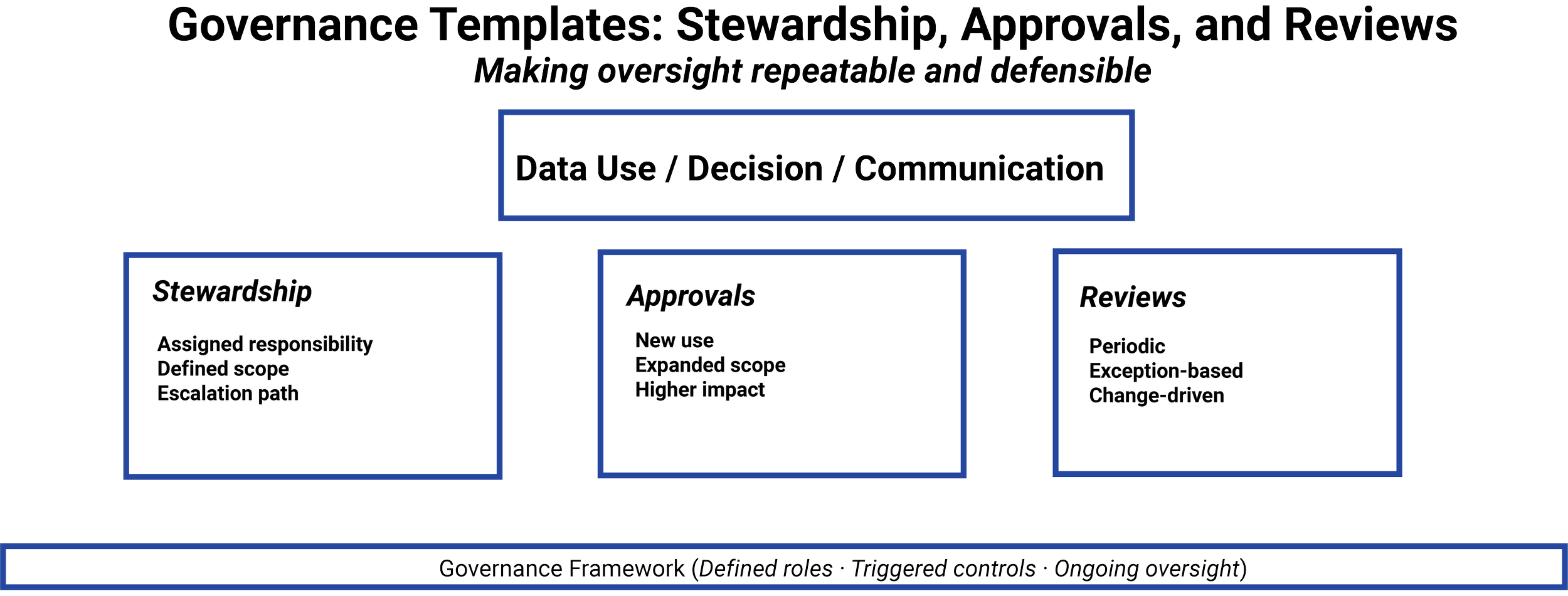

Strong data governance doesn’t emerge from principles alone. Regulators expect firms to translate governance concepts into repeatable structures that define responsibility, constrain use, and document oversight.

Many data-related failures occur, not because firms lack policies, but because governance is informal, inconsistent, or dependent on individual judgment. This lesson introduces governance templates that regulators commonly recognize: data stewardship, approval mechanisms, and review processes.

These templates provide a foundation for scalable oversight without requiring firms to reinvent controls for every dataset or use case.

IN THIS LESSON

Governance as structure, not discretion

In regulated finance, governance can’t rely solely on expertise or good intentions. Regulators look for evidence that responsibility is embedded in organizational structures rather than delegated informally.

Templates serve this purpose by standardizing how decisions are made, reviewed, and recorded. They reduce ambiguity, clarify accountability, and ensure that similar data uses are treated consistently across teams and time.

Governance templates don’t eliminate judgment. They ensure that judgment is applied within defined boundaries and can be defended later.

Data stewardship: assigning responsibility

Data stewardship is the practice of assigning clear responsibility for specific datasets or data domains. A data steward isn’t necessarily the data owner or technical custodian, but the role accountable for how data is interpreted and used.

Regulators expect firms to be able to identify who is responsible for overseeing data use, addressing questions about suitability, and escalating concerns when data is repurposed. Without a steward, responsibility often becomes diffuse, making supervision ineffective.

Effective stewardship frameworks define:

The scope of responsibility

Permitted uses of the data

Escalation paths for new or expanded use

This clarity is a cornerstone of defensible governance.

Approval mechanisms: controlling new or expanded use

Approval processes are how firms formally evaluate whether a proposed data use is permitted, appropriate, and sufficiently controlled. These mechanisms are especially important when data is repurposed, combined with other sources, or used in new contexts.

Regulators typically don’t require approval for every routine action, but they do expect firms to identify trigger points where review is required. These triggers often include changes in purpose, audience, or impact.

Well-designed approval templates capture rationale, assumptions, and conditions of use. They also create a record that can be referenced during audits or examinations.

Review processes: supervision over time

Governance doesn’t end once data use is approved. Regulators expect ongoing review to ensure that use remains consistent with its original purpose and conditions.

Review processes may include periodic assessments, exception reviews, or monitoring of downstream outputs. The goal isn’t constant reapproval, but confirmation that data hasn’t drifted into unintended or higher-risk use.

Reviews are especially important where data is reused across teams or embedded into analytics, reporting, or automated workflows.

Why templates matter for AI scalability

As data usage grows, ad hoc governance quickly becomes unmanageable. Templates allow firms to scale oversight without scaling complexity.

By standardizing stewardship roles, approval triggers, and review checkpoints, firms can accommodate new datasets and tools while maintaining consistent control. Regulators view this standardization as evidence of mature governance rather than bureaucratic overhead.

Templates make governance repeatable, auditable, and resilient.

Additional Resources

-

U.S. Securities and Exchange Commission — Examination Priorities and Risk Alerts

Repeatedly emphasize the need for identifiable responsibility, documented approvals, and ongoing supervision over data-driven activities.FINRA Rule 3110 — Supervision

Establishes expectations that firms implement supervisory systems that are structured, repeatable, and auditable—not discretionary.U.S. Securities and Exchange Commission — Marketing Rule (Rule 206(4)-1) Commentary

Reinforces that approval and oversight must exist before communications or analytics influence clients or markets.

-

COSO — Internal Control–Integrated Framework (Conceptual Guidance)

Emphasizes defined roles, approval controls, and monitoring as structural elements of governance—not optional practices.Office of the Comptroller of the Currency — Model Risk Management (SR 11-7)

Introduced the expectation that models, data transformations, and outputs must have owners, approvals, and review cycles.

-

National Institute of Standards and Technology — AI Risk Management Framework

Explicitly distinguishes between responsibility for data, responsibility for use, and responsibility for outcomes—mirroring stewardship and approval templates.Basel Committee on Banking Supervision — Principles for Risk Data Aggregation and Reporting

Highlights governance over data lineage, responsibility, and review as prerequisites for scalable analytics.

-

International Association of Privacy Professionals (IAPP) — Accountability Frameworks

Explores how assigning responsibility and documenting decisions reduces regulatory exposure across jurisdictions.Academic and industry commentary on operational risk governance

Reinforces that most governance failures arise from informal practices, not missing policies.