Documentation as a control, not an afterthought

Documentation is often treated as administrative overhead or a post hoc requirement. Regulators view it differently. From their perspective, documentation is a control mechanism that enables supervision, auditability, and accountability.

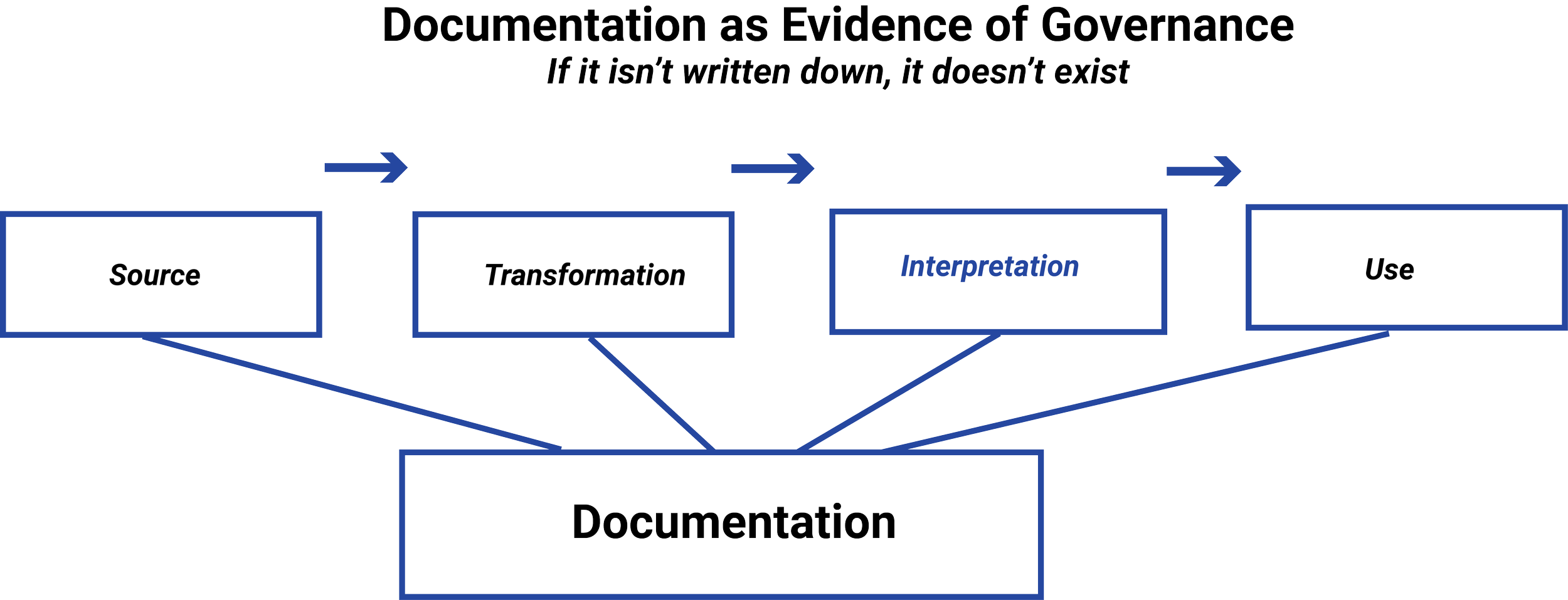

Effective documentation captures intent, rationale, and responsibility at the time decisions are made. It allows firms to reconstruct how data was selected, interpreted, transformed, and applied. Without this record, firms can’t reliably explain why particular outcomes occurred or demonstrate that risks were considered and managed appropriately.

What regulators expect to see documented

Regulators don’t expect exhaustive records of every data interaction. They do expect documentation that reflects material decisions, interpretive choices, and governance actions.

This includes records that explain:

Why a dataset was selected for a particular purpose

How it was interpreted or transformed

What assumptions or limitations were recognized

Who reviewed or approved its use

What controls governed reuse or escalation

The level of documentation required increases as data moves closer to influencing decisions, communications, or client outcomes.

Documentation must follow the data

A common failure is documenting only the final output or communication while leaving upstream data decisions undocumented. Regulators evaluate documentation holistically. They expect firms to be able to trace decisions back through the data lifecycle.

When documentation exists only at the end of the process, it becomes difficult to determine whether earlier interpretive choices were appropriate or supervised. This gap often leads regulators to question the reliability of the entire workflow.

Documentation should therefore be aligned with data movement, not just endpoints.

In regulated finance, undocumented decisions are treated as if they never occurred. Firms may apply thoughtful judgment, conduct reviews, and exercise oversight, but without documentation, regulators can’t verify that those controls existed.

Documentation isn’t a record of outcomes alone. It’s the evidence of governance, supervision, and accountability throughout the lifecycle of data use. This lesson explains what regulators expect firms to document and why informal or assumed records are rarely sufficient.

IN THIS LESSON

Informal documentation is rarely sufficient

Emails, chat messages, or undocumented discussions may reflect real decision-making, but they don’t reliably meet regulatory expectations. Informal records are difficult to retrieve, inconsistent in content, and rarely structured for audit replay.

Regulators expect documentation to be deliberate, accessible, and retained according to policy. This doesn’t require complex systems, but it does require consistency and discipline.

When firms rely on informal documentation, they place themselves in the position of having to reconstruct decisions after the fact, often under examination pressure.

Why this matters before analytics or AI

Analytics and AI systems can generate outputs rapidly, but they also obscure the human decisions embedded in their design and use. Without documentation of data selection, assumptions, and oversight, firms may struggle to explain how automated outputs were produced.

Regulators don’t accept automation as a substitute for documentation. In fact, they often expect more documentation, not less, when advanced tools are involved.

Establishing documentation standards before analytics or AI are introduced is good practice because it can help ensure that accountability remains visible even as processes scale.

Additional Resources

-

SEC — Books and Records Rule (Rule 204-2)

Establishes the requirement that investment advisers create and retain records documenting advisory activities, analyses, and decisions, reinforcing the principle that undocumented actions are treated as if they did not occur.FINRA Rule 4511 — General Requirements (Books and Records)

Requires broker-dealers to make and preserve records in a manner that allows regulators to review and reconstruct business activities, supporting audit replay expectations.FINRA Rule 3110 — Supervision (Conceptual Overview)

Emphasizes that supervisory systems must be evidenced through documentation, not assumed through informal oversight or verbal review.SEC Division of Examinations — Risk Alerts and Examination Observations

Frequently highlight documentation gaps as indicators of weak governance, particularly where firms cannot demonstrate how decisions were reviewed or approved.

-

COSO — Internal Control Framework (Documentation and Control Activities)

Frames documentation as a core control mechanism that evidences governance, supervision, and accountability rather than a procedural formality.Basel Committee on Banking Supervision — Risk Data Aggregation and Reporting Principles

Reinforce that documentation must support traceability and explainability across the data lifecycle, not just at final reporting stages.Enterprise Risk Management (ERM) Guidance on Control Evidence

Establishes that controls without documentation cannot be tested, audited, or relied upon, a principle directly applicable to data and analytics governance.

-

NIST — Data Governance and Risk Management Concepts

Treats documentation as essential to accountability, enabling organizations to explain how data was selected, transformed, and used over time.OECD — Accountability and Transparency Principles

Emphasize that decision-making processes must be documented in order to support oversight, review, and responsibility attribution.Regulatory Commentary on Model Risk Management (SR 11-7 Legacy Framework)

Introduced the expectation that assumptions, transformations, and judgments embedded in analytical processes be documented and reviewable.

-

UK Information Commissioner’s Office — Guidance on Accountability and Documentation

Provides practical illustrations of why informal records fail under regulatory scrutiny and why contemporaneous documentation is critical.Industry Commentary on “Audit Replay” and Defensible Governance

Explores how firms demonstrate compliance not through outcomes alone, but through the ability to reconstruct decisions in context.Academic Literature on Organizational Memory and Decision Traceability

Examines how undocumented decisions undermine institutional accountability, particularly in complex or automated environments.